Copyright © Silkbank 2025

Silkbank uses cookies. Read our cookie policy.

Welcome to the world of Silkbank Digital. Click & Bank at your convenience in the most secure and simple way. With Silkbank Internet Banking service you can access and manage your accounts anywhere, anytime. Now your bank is just a click away.

With Silkbank Digital you can enjoy these amazingly convenient internet banking facilities:

Balance Inquiry/Mini Statements/Transaction Details/Low Balance Alerts

Account Statement Requests

Fund Transfers

Pay Order/Demand Draft Requests

Cheque Book Requests

And Much More

To register for Silkbank Digital, please CLICK HERE or visit your nearest Silkbank branch. For more information, call 021-111-100-777 where our Phone Bankers are ready to assist you round the clock.

Simplify your life with Silkbank E-statement. You can request e-statement on a daily, weekly, monthly, quarterly, half-yearly or annual frequency.

Register yourself by filling out the application form and drop it at your Silkbank branch. An email will be generated confirming your Silkbank E-statement facility.

To register for this service, please visit your nearest Silkbank Branch. For more information regarding e-statements, call 021-111-100-333 where our Phone Bankers are ready to assist you round the clock.

In line with international banking standards, Silkbank is introducing the enhanced International Bank Account Number (IBAN) to enable you to easily and conveniently conduct international transactions as mandated by the State Bank of Pakistan (SBP) Circular, PSD Circular No. 02, of 2012, dated May 15, 2012.

Please note that the revision in your Silkbank IBAN account numbers is as follows:

Enhanced International Bank Account Number: PKKK BBBB CCCC CCCC CCCC CCCC

Old International Bank Account Number: PKKK BBBB CCCC CCCC CCCC CCCC

Silkbank Account Number: 0001-2000111111

You will continue to enjoy the same banking services as before with your enhanced IBAN. For daily banking or domestic transactions, you may use either your Silkbank Account Number or IBAN.

Should you have further inquiries, please feel free to call our 24 hours Customer Contact Center on the helpline: 021-111-100-777.

Why walk to bank when you can talk to the Bank!

With Silkbank Phone Banking, your account is on your finger tips. Silkbank Phone Banking officers ensure that your financial needs are taken care of with ultimate accessibility, convenience and security, 24/7 throughout the year.

Facilities through phone banking:

You can now avail the following facilities by simply calling our 24-hours phone banking.

Facilities through Interactive voice response (IVR):

In addition to product information , now you can access the following services for Bank Account and Credit Card through our Self-Service IVR :

You can access self-service banking facilities using a secure 4-digit TPIN number.

You can generate your TPIN by calling Silkbank Phone Banking.

Subscribe to Silkbank phone banking by calling 021-111-100-777 NOW!

Silkbank SMS Alerts Offer our customers the ability to stay informed around the clock, anywhere, any time.

Once enrolled for SMS Alerts, you will receive alerts on the transaction amount you select, from the following set of options:

Banking Transactions:

Internet/ATM Transactions:

For more information regarding product details or to find out how to register for this service, visit your nearest Silkbank Branch or call 021-111-100-333 where our Phone Bankers are ready to assist you round the clock.

Silkbank now offers its customers unmatched convenience and comfort with the launch of its Utility Bills Payment Service (UBPS). Customers can now use their Silkbank VISA Debit Card (VDC) at any Silkbank ATM to pay their utility bills or top up their mobile phones, around the clock, free of charge!

Customers Can:

Benefits

You can now enjoy the following benefits with UBPS:

Utilities

You can make payments using your VDC at any Silkbank ATM to the following companies:

| Companies | Mobile Operators |

|---|---|

| KESC | Ufone |

| SSGC | Warid |

| SNGPL | Telenor |

| LEPCO | Mobilink |

| GEPCO | |

| PTCL |

How to Make Payments

Follow these simple steps to make your utility or mobile bill payments”

Utility Bills

Mobile Bills

For more information,Visit your nearest Silkbank branch or call 021-111-100-777

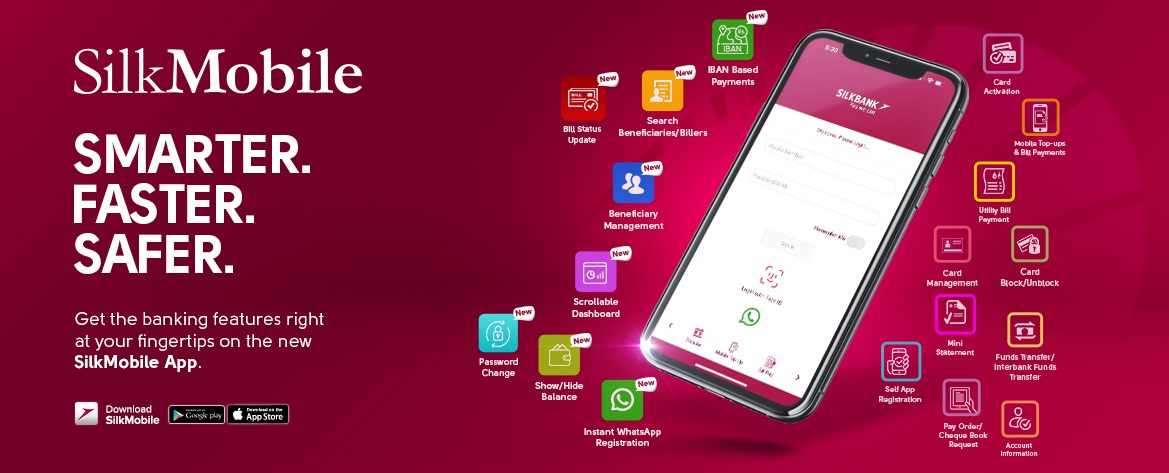

Silkbank brings you an amazing and innovative Mobile banking app that provides you with convenience and ease of performing secure transactions on the go, Anywhere, Anytime!

Not only that, but you can also perform several other functions such as:

HOW TO SUBSCRIBE

To register for this service, download the app from your respective app store and call our phone bankers at 021-111-100-777 to generate your MPIN. After that, you are free to transact away!

For further information, visit our website https://www.silkbank.com.pk.

How to register for Silkbank SMS Banking?

To start using SMS banking:

For example, if you select ‘1234’ as your pin then the SMS will be REG 1234 Once you register for the SMS banking, you will receive detailed SMS with short codes for the following services:

TERMS AND CONDITIONS FOR SMS BANKING

These terms and conditions shall form the agreement between Silkbank’s Customer and Silkbank Limited.

Definition:

In these terms and conditions, the following terms shall have the following meanings: “Facility” means the SMS banking facility granted by the Bank to the holder(s) of Silkbank Limited VISA/MasterCard and of any account and/or joint account and/or any other accounts or services as determined by the Bank from time to time. (“Account(s)”) means any or all bank accounts being maintained by the Customer with the Bank in any manner whatsoever for access to information on Accounts as may be prescribed by the Bank from time to time and usage of products and/or services as may be made available and included on mobile phone by the Bank from time to time. ”Bank” means any branch in Pakistan of Silkbank Limited with which the Customer’s Account is maintained; ”Customer” means the person who holds an Account with the Bank; “MSP” means any mobile service provider through whom the Customer or the Bank receives the mobile services as notified by the Bank. “Service Provider (s)” definition includes but is not limited to MSPs, organizations or individuals whose services the Bank uses in relation to SMS banking service in any capacity. “SPIN” means the 4 digit SPIN as provided by the Customer for authentication / verification by Bank of his / her identity. Customer will be able to obtain a range of financial information as determined by the Bank related to his/her relevant Account(s) through the use of SPIN and such other means of identification assigned to the Customer in connection with the Account(s) and Facility. “Alerts” means the customized messages sent either by short messaging service / text (“SMS”) over the Customer’s mobile phone, email, or fax or any other modes of communication determined by the Bank from time to time.

Availability

The Customer has requested for this Facility which the Bank at its sole discretion may discontinue at any time without any prior notice. The Facility is currently available only to resident Pakistani Customers with Account(s) maintained with the Bank. The Bank may wherever feasible shall extend the Facility to other MSP’s from time to time. The Customer assumes full responsibility for the security and confidentiality of his / her mobile phone / mobile phone number and SPIN to be used in initially gaining access to his / her enrolled Account(s) through the use of his/her mobile phone. The Facility may be extended by the Bank to any other accounts, products and / or services being offered by the Bank or otherwise at the sole discretion of the Bank from time to time. The Bank also reserves the right to make any additions or deletions in the services offered through Facility at any time and discretion of the Bank. The Customer shall inform the Bank immediately on surrendering / discontinuing use of the MSP’s mobile connection. The facility requiring telephonic verification against financial or other transactions as deem fit by the Bank will only be provided / performed within 1 working day after verification from the Customer of the request made via SMS banking.

Process

The Customer is duly bound to acquaint himself with the detailed process for using the Facility and the Bank is not responsible for any error / omissions by the Customer. The Customer acknowledges that this Facility of the Bank will be implemented in a phased manner and the Bank may at a later stage, as and where feasible; add more features to send the available Alerts. The Bank may, at its discretion, from time to time change the features of any Alerts / Facility. The Customer will be solely responsible for keeping himself updated of the available Alerts, which shall, on best-effort basis, be notified by the Bank from time to time through its website or through any other legally recognized medium of communication. The Bank is not bound to acknowledge the receipt of any query instructions nor shall the Bank be held responsible to verify any instructions. The Bank shall endeavour to provide instructions on a best effort basis and wherever operationally possible for the Bank. The Customer is solely responsible for intimating in writing to the Bank any change in his mobile phone number and the Bank will not be liable for sending Alerts or other information over the Customer’s mobile phone number in any way whatsoever. The Customer acknowledges that the Facility is dependent on the telecommunications infrastructure, connectivity and services within Pakistan. The Customer accepts that timeliness of Alerts sent by the Bank will depend on factors affecting the telecommunications industry. Neither the Bank nor its Service Providers shall be liable for non-delivery or delayed delivery of Alerts, error, loss, distortion in transmission of and wrongful transmission of Alerts to the Customer. The Bank shall endeavour to provide the Facility on a best effort basis and the Customer shall not hold the Bank or its partner(s) responsible / liable for non-availability of the Facility or any loss or damage caused to the Customer as a result of use of the Facility (including relying on the Alerts for the Customer’s investment or business purposes). The Bank or its Service Providers shall not be held liable in any manner to the Customer in connection with the use of the Facility by MSP. The Customer accepts that each Alert may contain certain Account(s) information relating to the Customer. The Customer authorizes the Bank to send Account related information, though not specifically requested, if the Bank deems that the same is relevant. The Customer must keep the SIM card and his / her mobile phone in secure / safe custody at all times. The Customer shall be solely responsible for the consequences in case the Customer fails to adhere to the above and / or in case of any unauthorized use of his/her mobile phone or SIM card. By agreeing to the terms and conditions of SMS banking, the Customer accepts the option to use the enhanced options, as and when they are made available by the Bank, which may include but not be limited to; transferring of funds, making bill payments, transferring from one currency to another. Upon the Bank offering the enhanced options, the Customer shall be advised the fees charged if any for the various enhanced options made available. Such Alerts shall be charged on a per transaction basis or otherwise as determined by the Bank from time to time.

Addition and Withdrawal or Termination of Facility

The Bank reserves the right to introduce additional service(s) with or without giving any notice to the Customer. The Bank reserves the right to send messages to the registered mobile phones regarding its products, services or any related matter, without the express consent of the Customer. The Bank may, in its discretion, withdraw temporarily or terminate the Facility, either wholly or in part, at any time without any liabilities on the part of Bank. The Bank may, without prior notice, suspend temporarily the Facility at any time during which any maintenance work or repair is required to be carried out or in case of any emergency or for security reasons, which require the temporary suspension of the Facility. Notwithstanding the terms laid down in clause 4.2 above, either the Customer or the Bank may, for any reason whatsoever, terminate this agreement at any time upon prior written notice that can be sent via SMS. Liabilities incurred by the Customer shall, however, survive the termination of this agreement.

Charges

The Customer will bear charges of sending commands via SMS to avail services. There are no charges on SMS Banking levied from the Bank to the Customer. However, Bank reserves the right to introduce any fee/charge on this facility in future as deemed fit. The same will be notified to the customer via schedule of charges and any other appropriate medium as deemed fit.

Disclaimer

The Bank or its employee/contractual staff will not be liable for: any unauthorized use of the Customer’s SPIN or mobile phone number/instrument or unauthorized access to e-mails received at his notified email address for any fraudulent, duplicate or erroneous instructions given by use of the same; acting in good faith on any instructions received by the Bank; error, default, delay or inability of the Bank to act on all or any of the instructions; loss of any information/instructions/Alerts in transmission/due to network failure; unauthorized access by any other person to any information/instructions given by the Customer or breach of confidentiality; The Bank shall not be concerned with and will not be held liable for any dispute that may arise between the Customer and the MSP and makes no representation or gives no warranty with respect to the quality of the Service Provided by the MSP or guarantee for timely delivery of the contents of each Alert. The Bank shall not be held liable for any disruption or failure of providing mobile telecommunication services by MSP. The customer agrees that any complaint in connection with the failure of mobile telecommunication services shall be referred to and addressed by the MSP. All responsibility of use of Facility by secondary cardholder/joint account holder shall be binding on all joint account holder and primary credit card holders.

Disclosure

The Customer accepts that all information/instructions will be transmitted to and/or stored at various locations and be accessed by personnel of the Bank (and its affiliates). The Bank is authorized to provide any information or details relating to the Customer Account or his card Account to the MSPs or any other service providers so far as is necessary to give effect to any instructions and/or to government/regulatory authorities/courts.

Liability and Indemnity

Service Provider(s)/Bank shall be free and harmless from and against all liabilities, losses, litigations, claims and damages arising from negligence, fraud, collusion or violation of the terms of this agreement on the part of the Customer and/or a third party. In addition, the Bank shall not be liable for any expense, claim, loss or damage arising out or in connection with this including but not limited to war, rebellion, typhoon, earthquake, electrical, computer or mechanical failures. The Customer shall indemnify and keep the Bank and its Service Providers.

Amendment

The Customer hereby, agrees to abide by, without need of notice and express consent, any and all future modifications, innovations, amendments or alterations to these terms and conditions made by the Bank from time to time.

Governing Law & Jurisdiction

This terms and conditions shall be governed and construed in accordance with the laws of Pakistan whose courts shall be courts of competent jurisdiction. This clause shall survive termination of this agreement.

Customer Agreement to these Terms

The use of short codes to avail service/information from the Bank via SMS banking will be considered as customer’s consent and agreement to the terms and conditions mentioned above for SMS banking.

Severability

If any part, term, provision or clause of the agreement proves to be invalid or unenforceable, the validity or enforceability of the remaining parts, terms, provisions and clauses will not be affected. The rights and obligations of the parties will be construed as if the agreement did not contain the particular invalid or unenforceable part, term, provision or clause.

Governing Law

These terms and conditions shall be governed by the laws of Islamic Republic of Pakistan.

In the fast-paced digital age, convenience and accessibility are key when it comes to managing your finances. That's why we're thrilled to introduce our revolutionary WhatsApp Banking Service.. With this cutting-edge offering, we've transformed the way you can interact with the bank, making it easier than ever to access your accounts, perform transactions, and get the information you need, all from the comfort of your favorite messaging app. Say goodbye to long queues and hello to hassle-free banking at your fingertips.

Silkbank WhatsApp banking solution offers: